What is Texas Medicare?

Medicare in Texas is federal healthcare that provides for many different healthcare costs. Texas Medicare is part of a nationwide program, which is administered by the U.S. Department of Health and Human Services. Most people who receive Medicare are seniors, aged 65 and older. However, some Texans with permanent disabilities and certain medical conditions also receive Medicare.

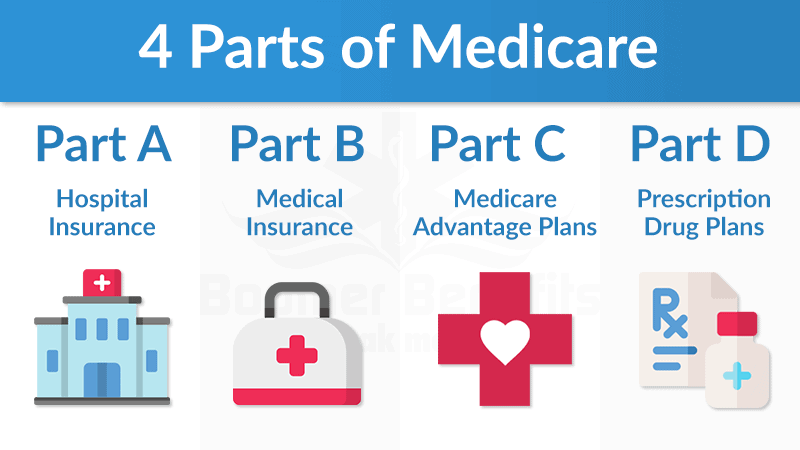

What are the parts of Texas Medicare?

Medicare in Texas is delivered through separate parts or plans. Each Medicare part covers a different variety of services. As your healthcare situation changes, you can adjust your Medicare coverage for the exact care you need. Coverage2Care can help you choose the right combination of plans for you.

Medicare Part A in Texas

Medicare Part A in Texas is hospital insurance. This Medicare portion covers you for hospital stays, skilled nursing facility treatment, hospice care, and some home health services.

Medicare Part B in Texas

Medicare Part B in Texas is medical insurance. This coverage includes visits to doctor’s offices, outpatient care, medical materials and supplies, and preventative or wellness care.

Medicare Part C in Texas

Also called Medicare Advantage, Medicare Part C plans offer the same coverage as Medicare Part A and B. Medicare Advantage plans combine hospital insurance, medical insurance, and some prescription drug insurance. Medicare Advantage plans in Texas and other states may charge fees, but also offer increased benefits not found in traditional Medicare options.

The main difference is that Medicare Advantage plans are administered by private insurance companies instead of by the U.S. Department of Health and Human Services. These private companies must follow all the same Medicare rules. You remain eligible for Medicare Part A and Medicare Part B if you choose a Medicare Advantage plan.

Medicare Part D in Texas

Medicare Part D in Texas is prescription drug insurance. This part of Medicare insures your prescription drugs, including many routine injections and vaccines.

How does Medicare in Texas work?

Texans have options for their Medicare coverage. Eligible patients can choose to enroll in “original” Medicare options. These are Medicare Parts A, B, and D, which cover hospital, medical, and prescription costs.

Texas residents can also choose a Medicare Advantage or Medicare Part C plan. These programs are offered by private companies but offer the same coverage as original Medicare plans. Costs and additional benefits may vary between different Medicare Advantage options.

Medigap or Medicare supplemental plans are also available through private insurers. These plans offer many different options but are designed to reduce the out-of-pocket costs faced by Medicare patients.

Who is Eligible for Medicare in Texas?

Most people become eligible for Medicare when they turn 65. Medicare is a government program that is funded through taxes. If you or your spouse paid Medicare taxes through a job for at least ten years, you are eligible for Medicare coverage in Texas.

In some circumstances, younger people are also eligible for Medicare. People with permanent disabilities, serious medical conditions, or permanent kidney failure (also known as End Stage Renal Disease) can receive Medicare before age 65.

Confused about your eligibility? Coverage2Care can help you determine if you’re eligible for Medicare in Texas.

How Do I Apply for Medicare in Texas?

People who are eligible for Medicare when they turn 65 can apply for Medicare coverage starting three months before their birthday. The Initial Enrollment Period spans seven months, including three months before and three months after a patient’s 65th birthday.

Seniors who are still working and are covered through their employer’s insurance can delay their Medicare enrollment period until retirement.

If you are on disability and qualify for Medicare, you can apply for coverage beginning the 22nd month after you began receiving benefits. In this case, the initial enrollment period lasts through the 29th month of your benefits.

There are three simple ways to apply for Medicare in Texas.

1. Apply in-person at your local Social Security Office

2. Call Social Security at 1 (800) 772-1213

3. Enroll online at www.ssa.gov

How Much Does Medicare Cost in Texas?

You may be wondering, is Medicare free in Texas? If not, how much does Medicare cost in Texas? Medicare costs vary depending on the plans you choose, but most seniors pay reasonable costs for their coverage.

Most people don’t pay anything for Medicare Part A coverage. This plan covers hospital insurance, including nursing facilities and some home healthcare services. Medicare Part A does have coinsurance fees, which can change throughout the year.

The usual premium for Medicare Part B in Texas is around $150 a year. Medicare Part B covers medical visits and doctor’s services. You’ll also have a coinsurance payment of around $200 for the year, and will be responsible for a portion of your care after the coinsurance is met.

Medicare Part C, or Medicare Advantage, plans are offered through private insurers. Medicare Advantage provides hospital and medical coverage, similar to Part A and Part B. Each private insurer sets its own rates, so Medicare Advantage costs will vary.

Medicare Part D costs also vary. This plan offers prescription coverage. Medicare patients with higher incomes may pay more for Medicare Part D.

Texas Medicare Enrollment Periods

Initial Enrollment Period

The Initial Enrollment Period is different for every Texan. Most people become eligible for Medicare when they turn 65. The Initial Enrollment Period is seven months long. It starts three months before a patient’s 65th birthday, includes their birthday month, and extends three months after their birthday as well.

General Enrollment Period

If you didn’t sign up for Medicare when you turned 65, it’s not too late. You can sign up for Part A or Part B during the General Enrollment Period, which lasts from January 1 to March 31 each year. Open enrollment for Part C, or Medicare Advantage, and Part D is October 15 to December 7 each year.

Special Enrollment Period

If you’re working and covered by your employer’s insurance during your Initial Enrollment Period, you can sign up for Medicare under a Special Enrollment Period. Your Special Enrollment Period lasts as long as your employer’s insurance is valid, plus eight months after that coverage ends.

How to Save on Medicare in Texas

Lower prescription costs

Medicare patients who meet certain income and resource limits can qualify for additional help. A program called Extra Help from Medicare provides for costs, premiums, deductibles, and other healthcare charges.

Medicaid

Medicaid is a program offered by the United States government and the State of Texas to help cover medical costs for people with limited income and resources. Medicaid offers some benefits that aren’t covered by Medicare.

Medicare savings program

The State of Texas can help you pay your Medicare premiums. For patients who qualify, a Medicare Savings Program can also provide for Medicare Part A and Part B costs such as deductibles, coinsurance, and copayments.

Frequently Asked Questions about Medicare in Texas

What information do I need to enroll in Medicare online?

You’ll need your basic personal information to enroll in Medicare online. This includes your full legal name, your telephone, your address, and your Social Security number. You’ll also need documents to prove your identity. These can include your birth certificate, passport, driver’s license, or permanent resident number.

Do I need to sign up for Medicare at 65 if I’m still working?

If you’re covered by your employer’s insurance when you turn 65, you do not need to sign up during your Initial Enrollment Period. You can sign up for Medicare at any time during your Special Enrollment Period, which lasts for eight months after your employer’s coverage ends. Medicare may be a better option than your employer’s coverage, so contact Coverage2Care to discuss your choices.

How do I change my Medicare coverage?

You can change your coverage during the Medicare Open Enrollment periods. Change your Part A, Part B, or Part C (or Medicare Advantage) coverage from January 1 to March 31 each year. You can change Part D, as well as Part C, from October 15 to December 7 each year.

When is the best time to enroll in Medicare?

The best time to enroll in Medicare is at the beginning of your Initial Enrollment Period, which starts three months before you turn 65. Enrolling at this time secures the lowest costs for your plan and helps you be covered immediately. However, it’s better to enroll late than never. If you did not enroll at 65 but want to now, Coverage2Care can help you make a plan.

What free preventive services does Medicare offer?

Medicare offers a range of free services. You will receive an initial free visit to gauge your general health, followed by annual wellness exams. Screenings for cancer, mental health, contagious disease, bone density, substance abuse, and many other concerns are available. Some preventative services are available annually, and others are upon a doctor’s recommendation.

Do you have other questions about Medicare in Texas?

You deserve to know your rights and choices about Medicare benefits in Texas. Knowing your rights and Medicare options is an important part of choosing the right Medicare coverage.

At Coverage 2 Care, we take the stress out of enrollment by helping you compare plans to find the right benefits for you. Our licensed professional agents will help you find affordable solutions to maximize your savings and get the coverage you need.

Contact us today to have one of our agents help you get the benefits you deserve!