Medicare Part D is prescription drug insurance for seniors. This program is an add-on to traditional Medicare and offers drug coverage for most people over the age of 65.

If you or your spouse paid Medicare taxes through a job for at least ten years, you have Medicare Part D eligibility. Some younger Texans with disabilities or liver failure are also eligible for Medicare.

Prescription drugs are a critical part of any health and wellness plan, but your medications can be expensive. Medicare can protect you from high drug costs and improve your quality of life. Keep reading to learn all about Medicare Part D.

What is Texas Medicare Part D?

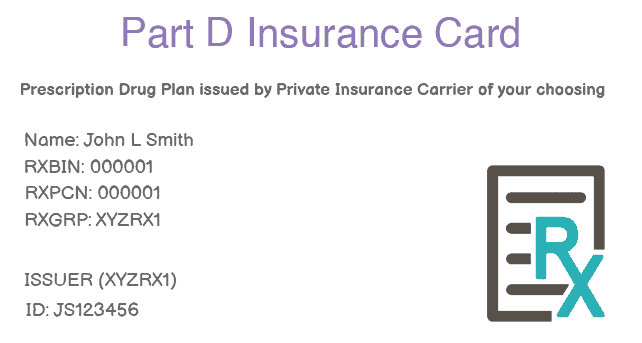

Texas Medicare Part D is insurance that covers your prescription drugs. While Medicare Part A and Part B are offered by the federal government, Medicare Part D coverage is provided by private insurance companies. You will need to purchase coverage from an insurance company for your medications to be covered.

Medicare Part D is an optional coverage, but you’ll pay less if you enroll as soon as you are eligible. Seniors who wait to sign up may face late-enrollment costs.

If you choose traditional Medicare, where you enroll in Part A and Part B through the government, you can purchase Part D coverage as a stand-alone policy from a private company. You can also add Part D to a Medicare Supplement Plan (Medigap coverage), or select a Medicare Advantage plan that includes prescription coverage.

What does Medicare Part D cover?

Your Texas Medicare Part D plan covers your prescription medications. Every Part D plan must meet a standard coverage level that is set by Medicare. Some plans go beyond this minimum and offer even more coverage.

Each insurance company can set a unique list of covered drugs, which is called a formulary. Plans can also assign medications to different “tiers” on their formularies. Each tier of drugs may be covered at a different rate. Formularies are different from plan to plan, so make sure you request a formulary copy as part of your research. Coverage2Care can help you determine which formulary is best for you.

How Much Does Medicare Part D Cost?

You’ll find different Part D costs depending on where you live. Most seniors can find Texas Medicare Part D plans starting at $14 a month.

As with many types of insurance, you’re responsible for some other costs with Part D. Your plan will likely include a yearly deductible, which you must meet before your plan starts paying for medications. You also generally have co-pays depending on your medication’s tier.

Is There a Deductible for Part D in Texas?

Every Part D plan is different, but you may face a deductible. You are responsible for paying your deductible before your plan will start paying for medication. Any co-pays also go into effect after your deductible is met.

For example, you may have a $100 copay and a tier 3 medication that is $42 per refill. In this situation, you would pay $142 the first time the prescription is filled, then $42 for each refill.

Who’s Eligible for Texas Medicare Part D?

Everyone eligible for Original Medicare (Part A and Part B) is also eligible for Medicare Part D. Most people have Medicare Part D eligibility beginning on their 65th birthday. If you or your spouse paid Medicare taxes for ten years or more through a job, you are eligible for Medicare.

Some younger people with permanent disabilities or liver failure (End-Stage Renal Disease) are also eligible for Medicare before turning 65.

You must be enrolled in Medicare Part A and/or Part B to sign up for Texas Medicare Part D. Your area of Texas must also be part of the service area for a Part D provider. If you’re not sure whether you qualify, Coverage2Care can help you figure out your Medicare Part D eligibility.

Texas Medicare Enrollment Periods for Part D

Initial Enrollment Period for Part D: Your 65th Birthday

For most people, Medicare Part D eligibility begins on their 65th birthday. You can sign up for Medicare starting three months before your 65th birthday. Your Initial Enrollment Period also includes your entire birthday month, as well as the three months following your birthday.

Annual Enrollment Period for Part D: October 15 – December 7

If you want to make changes to your Part D coverage, you can do this every year between October 15 and December 7. During this Annual Enrollment Period, you can add, change, or drop Part D coverage.

Medicare Advantage Open Enrollment Period: January 1 to March 31

Medicare Advantage plans are private insurance policies that meet federal Medicare requirements. Insurance companies that have contracts with the federal government administer these policies. Medicare Advantage policies take the place of Medicare Part A and Part B. Some also add prescription drug coverage from Part D. If you want to join, change, or drop Medicare Advantage coverage, you can do so every year from January 1 to March 31. You cannot make any changes to stand-alone Part D coverage at this time.

Special Enrollment Period for Part D

If you already have health insurance when you turn 65, you can choose to keep this coverage while keeping your Medicare Part D eligibility. You can sign up for Medicare with no penalties when your private insurance coverage lapses. Your Special Enrollment Period lasts for eight months once your previous insurance ends.

FAQ

What do the tiers on my Part D Mean?

Tiers are coverage ranges for prescription drugs. Your Part D plan may pay different amounts for different types or classes of medications. Here are some common examples of tiers.

- Tier 1: These medications have the lowest copayments. Most generic medications are Tier 1.

- Tier 2: This tier has a lower copayment and includes many preferred generic prescriptions.

- Tier 3: This medium copayment tier includes non-preferred, name-brand drugs.

- Tier 4: These brand-name drugs have a high copayment.

- Tier 5: Specialty prescription drugs at a very high cost.

If your doctor feels you need a drug from a more expensive tier, you may be able to request a lower copayment from your insurance company.

Every plan features a unique system of tiers, so compare your options before choosing a Part D plan.

What is a Formulary?

A formulary is a list of drugs that are covered by a Part D plan. Formularies include both brand name and generic medications, as well as at least two drugs in the most commonly prescribed types of medicine. Medicare Part D plans are usually required to cover two or more choices in each drug category, but insurance companies can choose which covered drugs they will offer.

A plan’s formulary may not cover your particular medication. In these cases, your doctor can usually prescribe something else which is covered. You or your doctor can also file an exception if your medication isn’t covered.

What is the Coverage Gap or Donut Hole?

Some Texas Medicare Part D plans do place a temporary limit on the covered cost of medication. In 2020, the coverage gap began after you and your Part D plan spent $4,020 on covered drugs.

Not all plans have this gap. People who receive Extra Help for paying their Part D costs do not face the coverage gap.

What are the pros and cons of Part D Prescription Drug Plans?

Pros of Medicare Part D:

Medicare Part D protects you financially by helping to pay for prescription medicine. These affordable plans have low premiums.

You also enjoy the freedom to make choices about your prescription coverage. You can add Part D coverage as a stand-alone policy to supplement Original Medicare, or you can purchase this coverage as part of a Medicare Advantage plan.

Cons of Medicare Part D:

Because Part D plans differ from one insurer to the next, you must research your options to find the best fit. To get the most from each plan, you need to anticipate your medication coverage for the coming year. Not all plans cover all drugs.

You can also face a penalty for late enrollment, even if you don’t need prescription drug coverage when you first become eligible.

What Drugs are Covered by Medicare Part D in Texas?

Texas Medicare Part D covers maintenance medications that you take to treat ongoing or chronic conditions. These drugs include medications for blood pressure or heart disease. Part D also covers short-term prescriptions, such as a round of antibiotics.

Some medications are covered by Medicare Part B, which primarily covers medical visits. Coverage2Care can help you determine which prescriptions are covered by which plan.

What Drugs Are Not Covered by Medicare Part D in Texas?

Part D coverage excludes some medications. These include drugs for eating disorders or weight maintenance; fertility treatments or erectile dysfunction medicines; and prescriptions used for cosmetic reasons such as hair growth. Prescription vitamins and over-the-counter drugs are also not covered.

How do you choose a Medicare Part D plan?

When you’re choosing a Part D plan, consider all your medications. Make sure to check each plan’s formulary to see if your medicines are included. Research each plan’s cost, including monthly premiums, copays, and deductibles. Your best choice will offer a balance of value and coverage.

What is The Medicare Part D Late Enrollment Penalty?

If you don’t enroll when your Medicare Part D eligibility begins, you may face a late enrollment penalty when you do sign up. This penalty is a higher monthly premium, which you pay for as long as you do have Part D coverage. Even if you do not want Part D coverage when you first become eligible, you are still subject to the penalty if you spend more than 63 days in a row without coverage.

Still Have More Texas Medicare Questions?

Texas Medicare Part D plans give you many choices for your prescription coverage. Contact Coverage2Care to learn more about your options and find the plan that’s best for you.